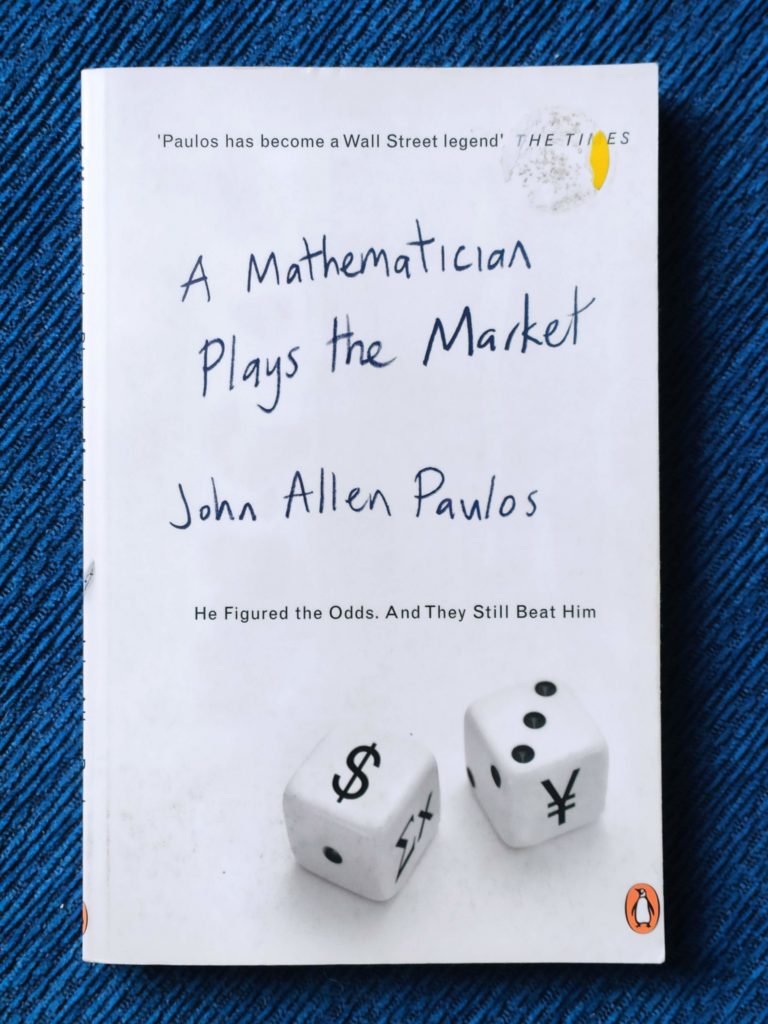

Back in the dot-com bubble of 20-odd years ago, WorldCom was one of the many companies that crashed and burned, taking investors’ money with it. John Allen Paulos was one of these investors, obsessively throwing good money after bad, long after the point when he should have cut and run. In this book he tries to explain why he succumbed to the madness of crowds like that, and in the process explains a lot about how the stock market works. He also discusses lots of interesting mathematical details, and also the benefits and pitfalls of various investment approaches.

I was gratified that he more-or-less agrees with my long-held belief that so-called “technical analysis” of stock prices is mostly utter nonsense. This is the idea that you can use mathematical techniques to analyse past price movemtns and thus predict future movements. The more I think about it, the more I realise that technical analysis is like astrology: pseudoscientific mumbo-jumbo purveyed by people who not only don’t know what they’re talking about, but don’t even know that they don’t know what they’re talking about.

It’s a fun book to read (it helps if you like maths). Paulos has a nice self-deprecating view of the irrational exuberance that lost him that money, and there are a few amusing anecdotes along the way. And he purveys a piece of advice that applies to pretty much every part of life:

Always be smart; seldom be certain.

I found this book to be quite helpful and relevant to my dabblings in the cryptocurrency markets, even though it’s focused on the US stock exchanges and predates most of the Internet-enabled investing methods available today. If you’re an investor, or planning to be one, you really should read this book.